1919 Investment Counsel

Our research driven process seeks to uncover compelling opportunities in the stocks of high-quality companies with strong balance sheets, competitive solutions, and large addressable markets.

1919 Disruptive Innovation Strategy

Seeks to invest in companies that are driving change in established markets through disruptive innovation. The strategy invests across all sectors, geographies, and market capitalizations over $1 billion. The holding period is aligned with the timeframe needed for each company to establish leadership within their respective industry.

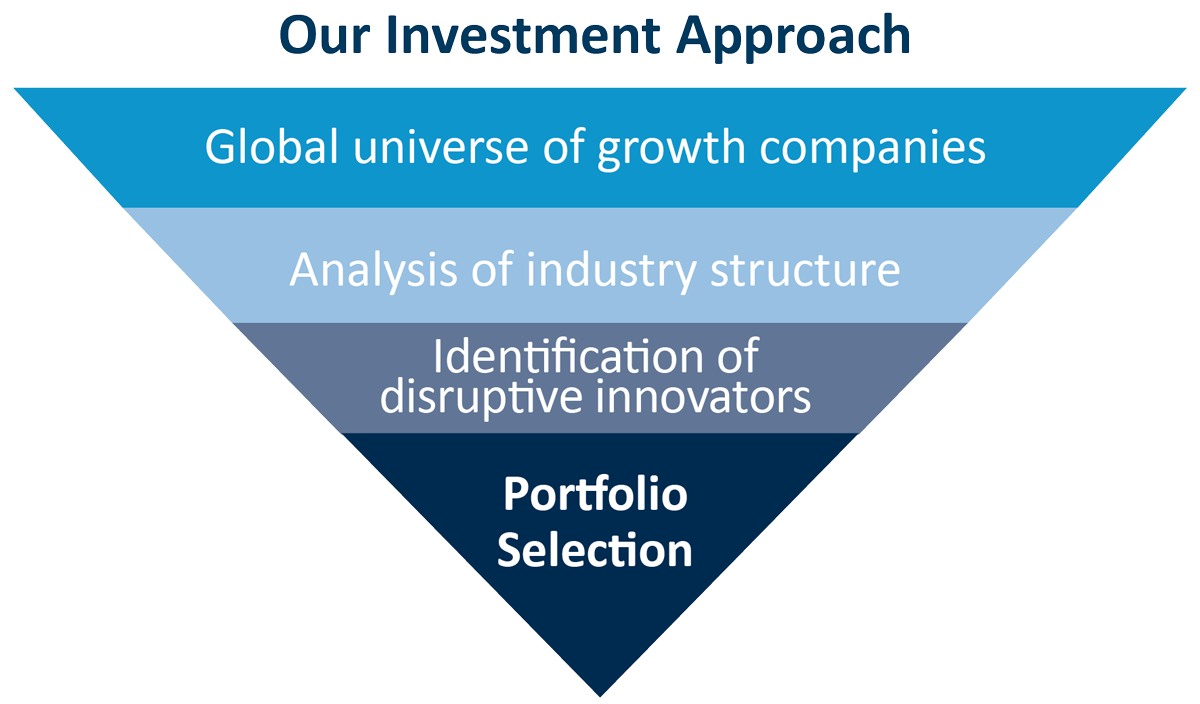

Investment Approach

The strategy is managed thematically, investing in 35-45 companies who are best-positioned across 15-20 investment themes.

Risk is managed through thematic diversification

- Exposure to a single theme is limited to 10% or less of the portfolio

- Exposure to a single stock is limited to 5% or less of the portfolio

Selection is biased towards companies demonstrating high revenue growth and profit margins

Valuation is evaluated over a multi-year timeframe

Targeted annual turnover is below 30%

The benchmark for the Strategy is the Russell 1000 Growth Index.

Disclosure

All investments involve risk, including risk of loss and there is no guarantee investment objectives will be met.