1919 Investment Counsel

Our research driven process seeks to uncover compelling opportunities in the stocks of high-quality companies with strong balance sheets, competitive solutions, and large addressable markets.

1919 REIT Strategy

Seeks capital appreciation and a growing stream of distributable cash flow over a full market cycle by investing in a select portfolio of 20-25 real estate companies with leading competitive positions, quality corporate governance, an ability to generate strong, sustainable cash flows, and that benefit from positive secular industry dynamics.

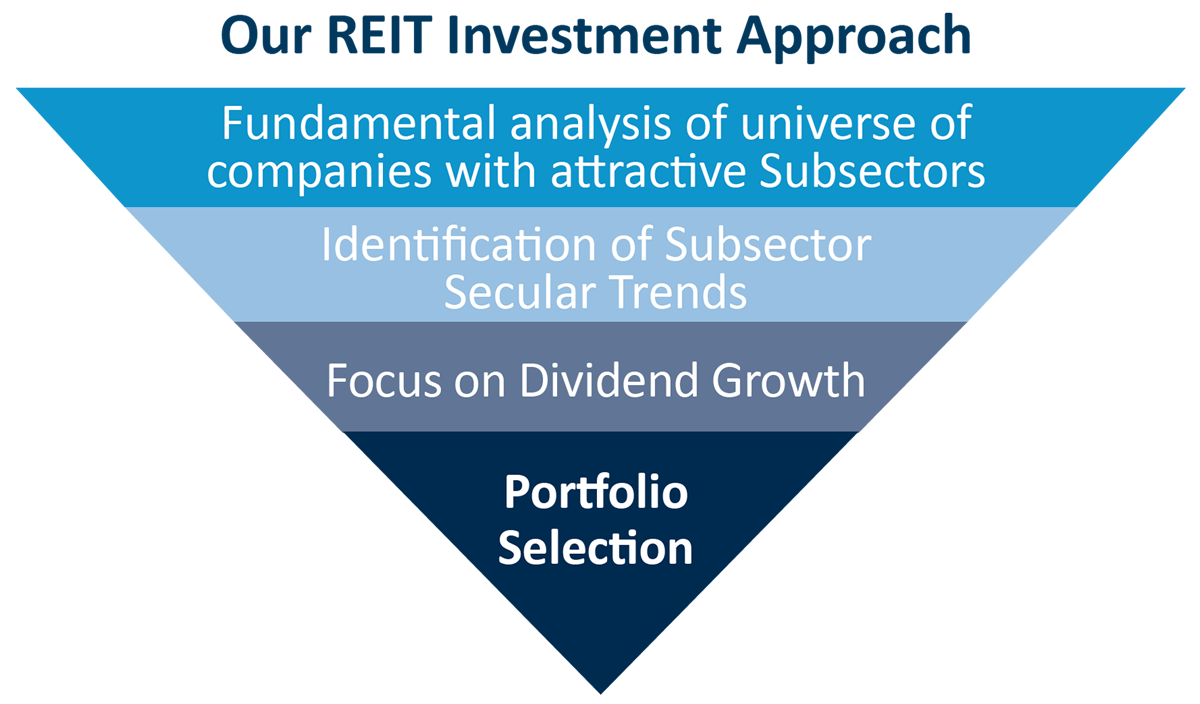

Investment Approach

We follow a disciplined and fundamentally driven bottom-up process to identify attractively valued real estate companies and provide:

Practiced investment strategy focused on 20-25 high-quality, market-leading real estate companies

Flexible and fluid approach to subsector positions in a constantly evolving macro environment

Attractive complement to a core investment portfolio that leverages 1919 Investment Counsel's extensive in-house fundamental research capabilities

Disclosure

All investments involve risk, including risk of loss and there is no guarantee investment objectives will be met.