1919 Investment Counsel

Our in-depth proprietary research and rigorous credit analysis identifies compelling, high-quality, fixed income opportunities while proactively managing risk in highly customized client portfolios.

1919 Taxable Full Duration Fixed Income Strategy

Seeks long-term, attractive returns while managing risk by investing in a diversified portfolio of Treasuries, Agencies, mortgage- and asset-backed securities, and investment-grade corporate bonds. Employs a total return strategy focused on the entire maturity spectrum.

Our Latest Strategy Materials

Fact SheetInvestment Approach

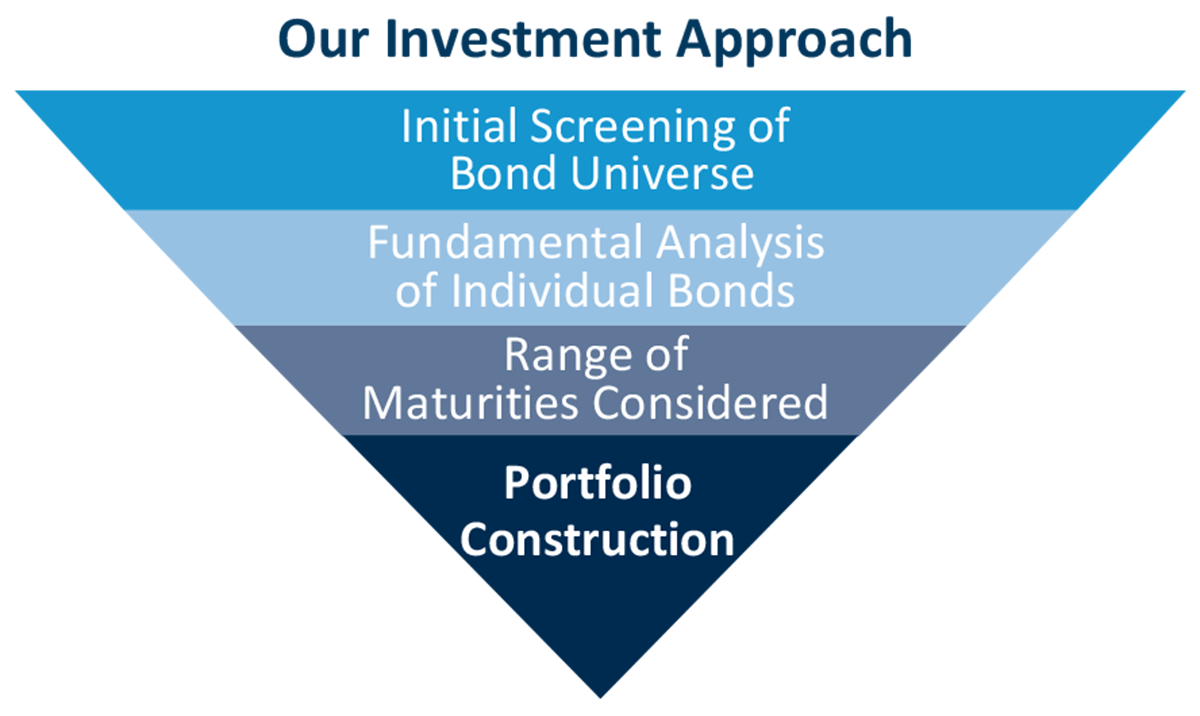

A top-down, macro approach is utilized when determining sector, duration, and term structure decisions:

Proprietary research and credit resources are leveraged to manage credit risk

Identify sectors with the greatest return potential

Select bonds based on credit fundamentals and security structure

Manage maturity and term structure according to economic outlook, interest rate forecasts and yield curve analysis

Portfolio Selection/Construction

Disclosure

All investments involve risk, including risk of loss and there is no guarantee investment objectives will be met.