1919 Investment Counsel

Our research driven process seeks to uncover compelling opportunities in the stocks of high-quality companies with strong balance sheets, competitive solutions, and large addressable markets.

1919 Equity Income Strategy

Seeks capital appreciation with less downside than the overall market, as measured by the S&P 500 Index. A significant portion of the strategy's total return is derived from the dividend yield provided by its portfolio of high-quality dividend-paying stocks.

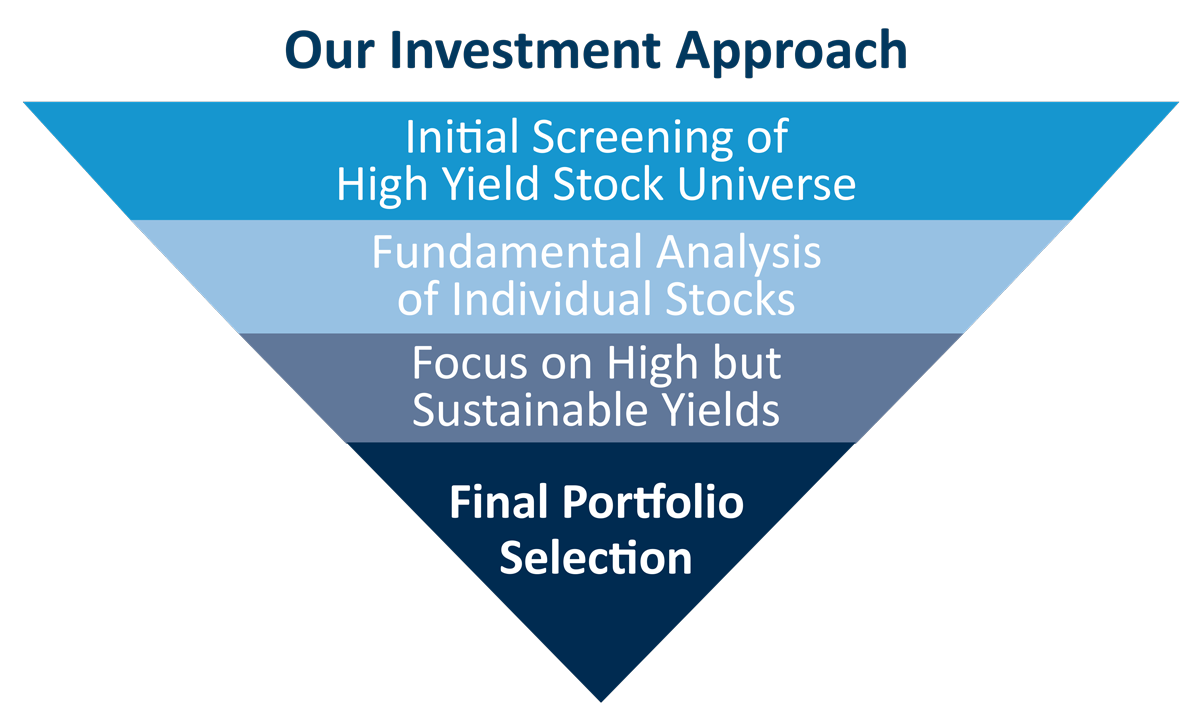

Investment Approach

We follow a disciplined and fundamentally driven bottom-up process focusing on companies with:

Attractive dividend yields and the capacity to grow their dividends over time

Sustainable competitive advantages, strong cash flow, healthy balance sheets, and high returns on capital

The strategy is diversified by sector rather than limiting stock selection to the highest dividend-yielding sectors.

Disclosure

All investments involve risk, including risk of loss and there is no guarantee investment objectives will be met.